Calculating Global Demand For WWE Network

Estimating WWE Network Demand

How can we estimate how many people will sign up for the WWE Network? One place to start is to look at at 2006-2013 PPV buy history.

We'll separate PPVs into three categories: Wrestlemania, A-level and B-level.

A-level PPV: Royal Rumble & SummerSlam B-level PPV: Remaining PPVs besides Wrestlemania

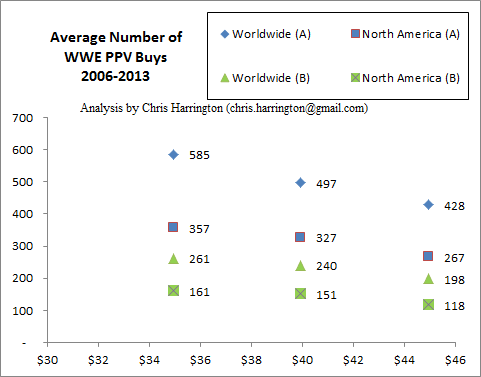

Average of A-level PPV at different Price Points

$34.95 SD: 585k worldwide (357k North America) $39.95 SD: 497k worldwide (327k North America) $44.95 SD: 428k worldwide (267k North America)Average of B-level PPV at different Price Points

$34.95 SD: 261k worldwide (161k North America) $39.95 SD: 240k worldwide (151k North America) $44.95 SD: 198k worldwide (118k North America)

Immediately, we see some interesting behavior - the drop in North American buys during the latest $5 increase is much more severe than the previous increase (-9% vs -18% for A-level PPVs, -6% vs -22% for B-level PPVs). It appears there is variable price elasticity depending on the price point. So, we'll want to develop a pricing model that appears to take this into account. How you choose to do this is going to vary from analyst to analyst; I'll implement a demand model that I've used in the past.

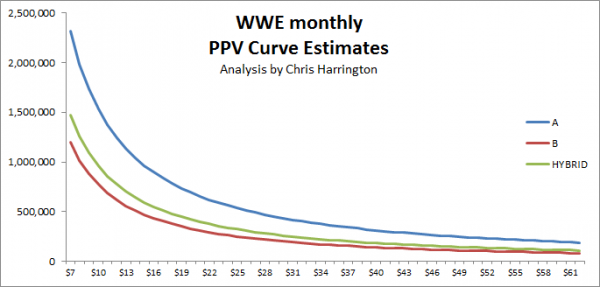

Buys(price) = constant*(price^intercept)

NA_Buys_A(price) = 21,710,657*(price^-1.150) NA_Buys_B(price) = 12,982,537*(price^-1.226)I'll also add in a "Hybrid" line which will be weighted between the two buys curves: we'll use 3 A-level events and 9 B-level events: Hybrid_Buys=(3/12)*Buys_A+(9/12)*Buys_B

This is only covering the "North American" buys curves. Keep in mind that "North America" in WWE's financial book is both US and Canada; however, the Domestic WWE Network is only launched in the United States at this time. (At this time, let's set aside the discussion over how many people are currently using the WWE Network but are not based in the United States.)

At current price point: $9.99/month...

NA_Buys_A($9.99) = 1,538,766 (annual revenue: $184,467,299) NA_Buys_B($9.99) = 772,489 (annual revenue: $92,605,976) NA_Hybrid($9.99) = 964,058 (annual revenue: $115,571,307)So, the estimate for what a ten-dollar a month service would hit (in theoretical world) would be about 4% short of a million domestic subscribers. You can also split the estimate into Jan-June (which has two A-level events) and July-Dec (which has one A-level event), that would be 1,027,915 for the first half of the year and 900,202 for the second half of the year (average is 964,058 across the whole year). That also suggests that about 87.5% of the WWE Network subscribers would stick around during the "slow period" renewal and we'd see about 127,713 subscribers that would return each year for the Wrestlemania period.

The next step is trying to estimate the Global Demand. We did have "worldwide PPV" number previously but it's a hardly a perfect metric. Not every PPV was offered as a pay event on international providers. The price for the PPV wasn't the same internationally as it was domestically. So, instead of working off Worldwide PPV curves, I am create a relationship between North American PPV demand and Worldwide PPV demand.

We know that historically, PPV buys are slightly over 60% North American and 40% Remaining International. PPV Revenue was split 80% Domestic and 20% Remaining. This suggests that we can estimate the non-US demand to be somewhere between a third (40%/60%) and a quarter (20%/80%) of domestic demand. If we split the difference, that would suggest that Demand for non-US WWE Network is would be an additional 29%.

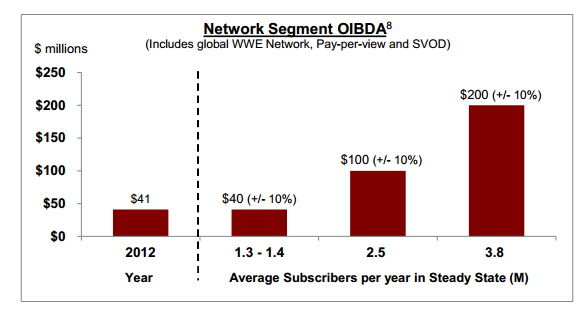

Worldwide_Buys($9.99)=1.29*NA_Hybrid($9.99)=1,243,635 subscribers (annual revenue: $149,086,942Turning to the WWE Presentation, there are three scenarios called out in the Business Outlook:

At 1.3M to 1.4M subscribers at Steady State, the WWE Network Segment would generate about $40M in OIBDA (which is roughly equal to the OIBDA that was generated back in 2012 from the PPV segment.) At 2.5M subscribers at Steady State, the WWE Network Segment would generate about $100M in OIBDA and at 3.8M subscribers, the WWE Network Segment would generate about $200M in OIBDA.

Assuming $9.99/subscriber

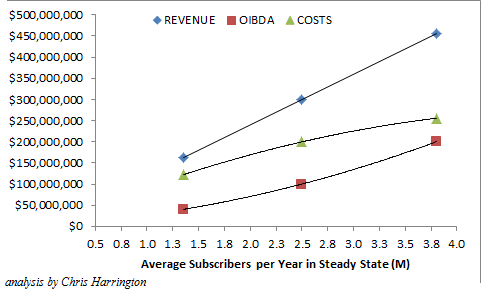

1.35M subscribers = $161,838,000 annual revenue = $40,000,000 OIBDA = $121,838,000 Costs 2.50M subscribers = $299,700,000 annual revenue = $100,000,000 OIBDA = $199.700,000 Costs 3.80M subscribers = $455,544,000 annual revenue = $200,000,000 OIBDA = $255,544,000 CostsRight now, the pricing model is suggesting that Global Demand would be about 1.25M subscribers in steady state (though that assumes that WWE Network would be fully distributed in all markets, not just English-speaking markets). The estimated 1.25M demand number (for $9.99/month) is slightly below the "break-even" point given in WWE's presentation. (This is looking at matching the PPV segment revenue; cannibalization from Home Entertainment seems to be left to it's own devices.)

You'll notice that while Revenue grows linearly, both Costs and OIBDA are "bowed". Not only is there significant fixed and variable costs depending on number of subscribers, but there are additional complexities which are evidently being absorbed (staffing, bandwidth, economies of scale, additional revenue cannibalization) which may be affecting these curves.

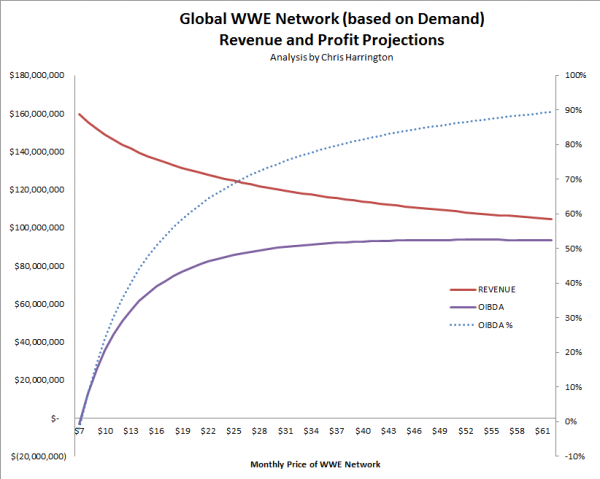

In this example, you can see the OIBDA projections (based on the demand model) for various monthly prices.

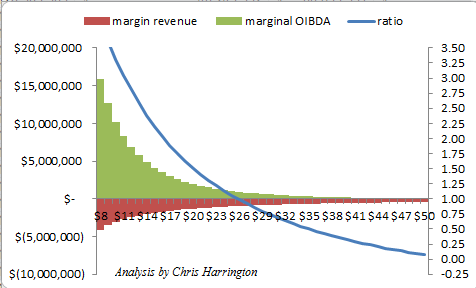

At $9.99/month, estimated 1,242k global subscribers annually generating $148.9M revenue and Network OIBDA of $35.7M (24%). At $12.99/month, estimated 999k global subscribers annually generating $141.5M revenue and Network OIBDA of $56.7M (40%). At $14.99/month, estimated 765k global subscribers annually generating $137.6M revenue and Network OIBDA of $65.6M (48%). At $19.99/month, estimated 543k global subscribers annually generating $130.1M revenue and Network OIBDA of $78.9M (61%).Initially, based on my demand projections, the only way that WWE is going to be generating significant OIBDA would be from raising the WWE Network price. This would likely reduce the service to less than a million global subscribers, but the loss of top line revenue is offset by a growth in OIBDA. (For instance, the cost of moving from $12.99/month to $13.99/month is losing -$2.22M in revenue but WWE would gain $5.7M in OIBDA.) The marginal OIBDA gain equals the margin Revenue loss around $25/month. So, WWE has significant room to raise the price to improve OIBDA, even with lowered demand forecasted.

Clearly, everything demands on the appropriate demand forecast model coupled with an understanding of the cost/pricing structure of global WWE Network launch.

The biggest issue is that WWE seems to either believe the domestic market for the WWE Network is much larger than a million people or they believe that the global demand for the WWE Network will represent significantly more than 40% of the service. Either way, that's a large leap from where we stand today. Chris Harrington (chris.harrington@gmail.com) is a WWE Business Analyst who publishes exclusively at WhatCulture.